Considering new windows for your home can feel like an overwhelming investment. Here at Arizona Window Company, we understand that the financial aspect is one of the biggest hurdles homeowners face. That’s why we’ve created this comprehensive guide on financing options for your new home windows project! By exploring a variety of solutions, this article is designed to ease your decision-making process and help you transform your home’s aesthetics and efficiency.

Contents

- 1 Understanding the Importance of New Windows

- 2 Assessing Your Budget and Financial Needs

- 3 Personal Loans and Lines of Credit

- 4 Home Equity Loans and HELOCs

- 5 Contractor Financing Plans

- 6 Government and Energy Efficiency Programs

- 7 Credit Card Financing Options

- 8 5 Key Considerations When Choosing Financing

- 9 Leveraging Manufacturer Deals and Promotions

- 10 Utilizing Savings and Strategic Planning

Understanding the Importance of New Windows

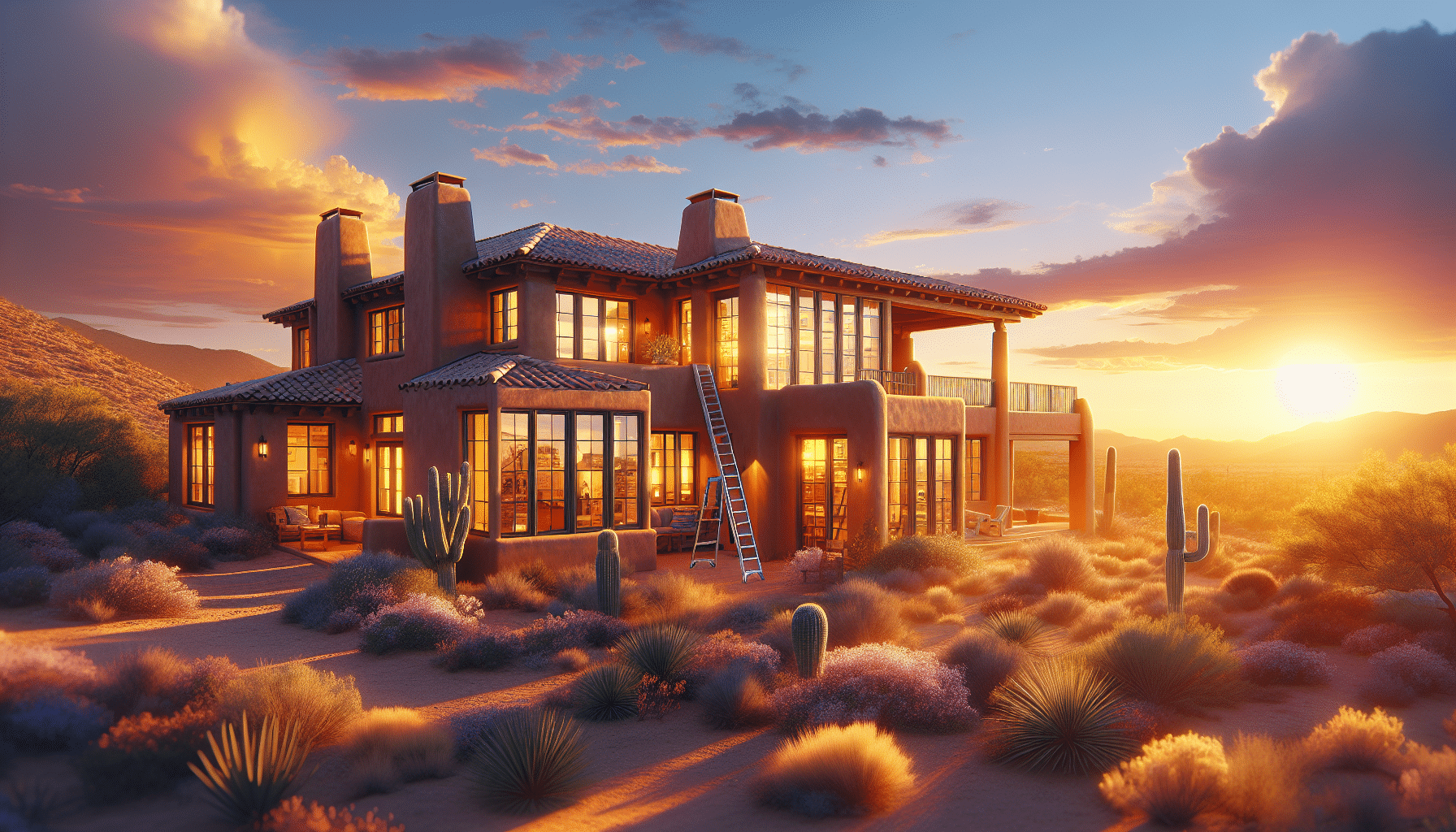

New windows do more than just improve your home’s appearance; they enhance energy efficiency, increase property value, and provide better insulation. As a homeowner, recognizing when your windows need an upgrade is the first step toward reaping these benefits. By choosing the right windows, you can enjoy a more comfortable interior environment and potentially lower energy bills.

Moreover, upgrading to energy-efficient windows can be a pivotal aspect of sustainable living. These windows play a crucial role in reducing your home’s carbon footprint, making it not only a financially beneficial move but also an environmentally responsible choice.

Assessing Your Budget and Financial Needs

Before diving into financing options, it’s essential to have a clear understanding of your budget and financial needs. A well-planned budget helps you manage costs and guides your choices during the selection process. By assessing your current financial situation, you can determine how much you’re willing to spend and what type of financial assistance you might require.

Beyond just the price of the windows themselves, consider installation and long-term maintenance costs. These factors play a significant role in calculating the overall investment and ensuring you choose the best possible financing option for your new windows.

Personal Loans and Lines of Credit

One popular financing option is to take out a personal loan or tap into a line of credit. This choice can provide you with the necessary funds without putting your home at risk. With a personal loan, you receive a lump sum that is repaid over a fixed term, making it easier to plan your finances.

On the other hand, a line of credit offers more flexibility, allowing you to borrow up to a set limit as needed. This arrangement can be particularly useful if your window project requires additional, unforeseen expenses. Both options come with interest rates, so it’s crucial to compare lenders and terms before committing.

Home Equity Loans and HELOCs

Home equity loans and Home Equity Lines of Credit (HELOCs) are excellent ways to utilize your home as collateral for financing. A home equity loan provides a lump sum payment with a fixed repayment plan, while a HELOC functions more like a credit card, with a revolving credit line that you can draw from as necessary.

These options can be attractive due to their typically lower interest rates compared to personal loans. However, it’s important to remember the risk of using your home as collateral, as failing to make payments could result in foreclosure.

Contractor Financing Plans

Many window companies, including us, offer in-house financing plans. These plans can simplify the financing process by allowing you to finance directly through the vendor without involving a third-party lender. It’s often easier to negotiate terms and conditions tailored to your needs with contractor financing.

When considering contractor financing, always review the fine print and ask questions about interest rates and any potential fees. Knowing the details upfront ensures you make an informed decision that aligns with your financial expectations.

Government and Energy Efficiency Programs

There are government-backed programs designed to help homeowners upgrade to energy-efficient windows. These initiatives often offer grants, rebates, or low-interest loans that make your investment in new windows more affordable.

Researching local and federal programs can uncover opportunities to save money and reduce the initial outlay costs. Programs such as the Energy Star rebates can provide significant financial relief for environmentally friendly home improvements.

Credit Card Financing Options

Using a credit card for financing your window project might seem unconventional, but it can be a viable option if you have a card with a low-interest or promotional zero-interest period. Such cards can provide flexibility and ease, especially if you plan to repay the amount quickly.

However, relying on credit cards requires discipline and a strong repayment plan to avoid high interest piling up. We recommend evaluating your ability to pay off the balance within the promotional period before deciding.

5 Key Considerations When Choosing Financing

- Interest Rates: Explore and compare different financing options to find the lowest interest rates, as they determine the overall cost of your loan.

- Loan Terms: Consider the loan’s duration—shorter terms often have higher monthly payments but lower total interest amounts.

- Credit Score: Your credit score influences your loan options and interest rates, so it’s wise to check and improve your score if necessary.

- Fees and Penalties: Review the loan agreement for any hidden fees or penalties for early repayment to fully understand the cost.

- Financial Flexibility: Choose a financing option that aligns with your financial situation, providing sufficient flexibility for your needs.

Leveraging Manufacturer Deals and Promotions

Window manufacturers often have promotions and deals that can save you money on new windows. By staying informed about these opportunities, you can take advantage of reduced prices and special financing offers.

Reach out to our team at Arizona Window Company to learn about any current promotions we have available. Together, we can find a solution that meets your budget needs while still delivering top-notch Products.

Utilizing Savings and Strategic Planning

Lastly, don’t underestimate the power of simple savings and strategic financial planning. Setting aside money over time specifically for your window project allows you to lessen the need for external financing.

Even if savings don’t cover the entire cost, they can reduce the amount you need to borrow. This strategy not only saves interest payments but also provides a sense of accomplishment and preparedness.

Securing the right financing for your new home windows project is crucial, and we’re here to help every step of the way. Contact Us today at 480-526-4456 or Request a Free Quote to start transforming your home with Arizona Window Company!